Welcome to Kucharo Wealth, where we specialize in helping dentists, orthodontists, and other specialists in the dental profession achieve their financial and life goals. By partnering with us, your dreams become a financial reality by transforming your aspirations into a well-planned and prosperous future.

— Benjamin Franklin

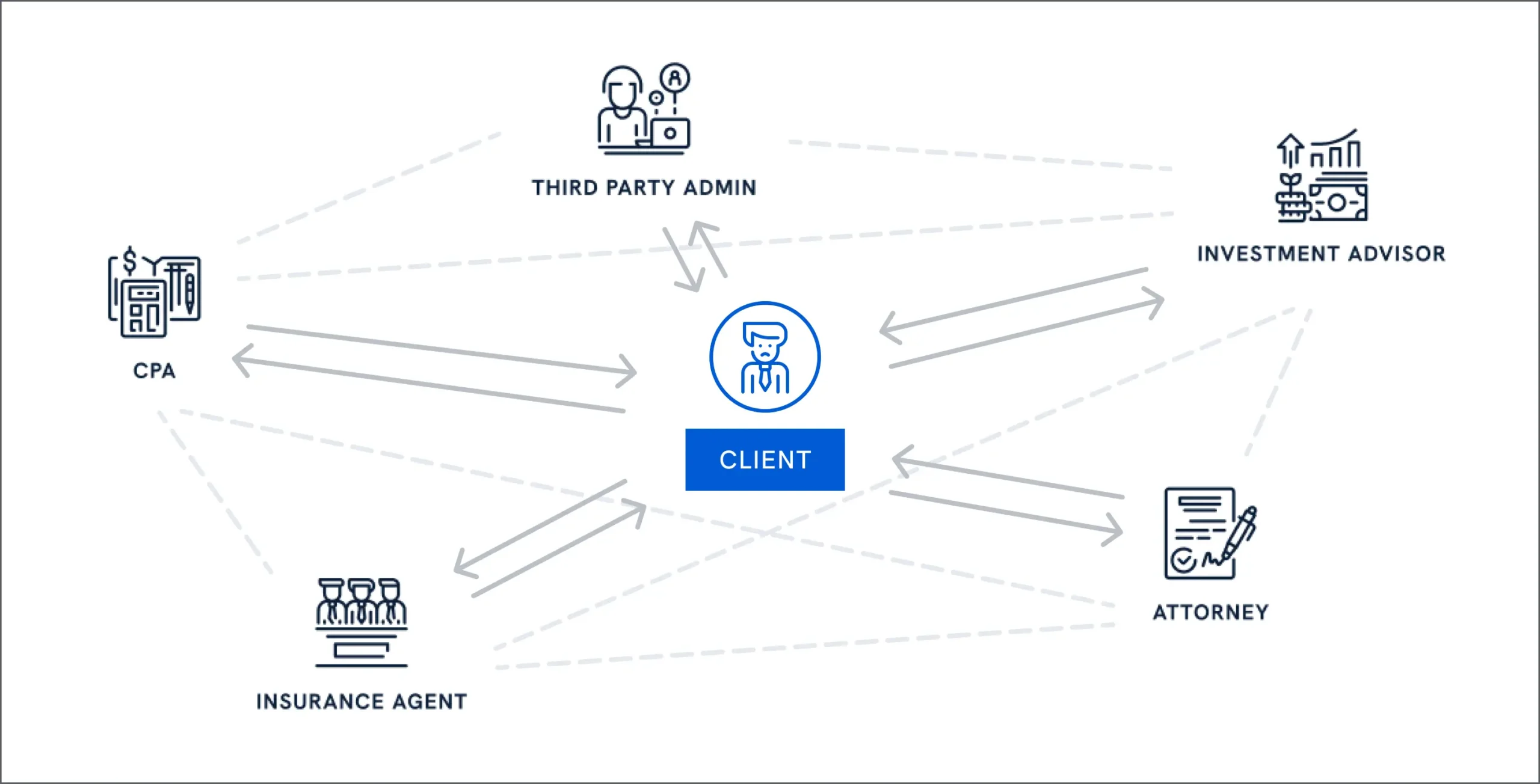

Most doctors didn’t go to school to be an entrepreneur or CEO, yet they find themselves having to wear both of these hats. This can cause an incredible amount of stress which can often feel overwhelming.

In order to alleviate the stressful financial pressure experienced by many doctors, and survive and thrive in today’s rapidly changing environment, doctors need an ally to reach their maximum potential and guide them to financial freedom.

A personal CFO as your guide is a great place to start.

At Kucharo Wealth, we’re not just financial advisors; we’re your partners in success. Our team brings a wealth of experience and expertise to guide you on your journey to financial freedom.

How a Personal CFO Helps

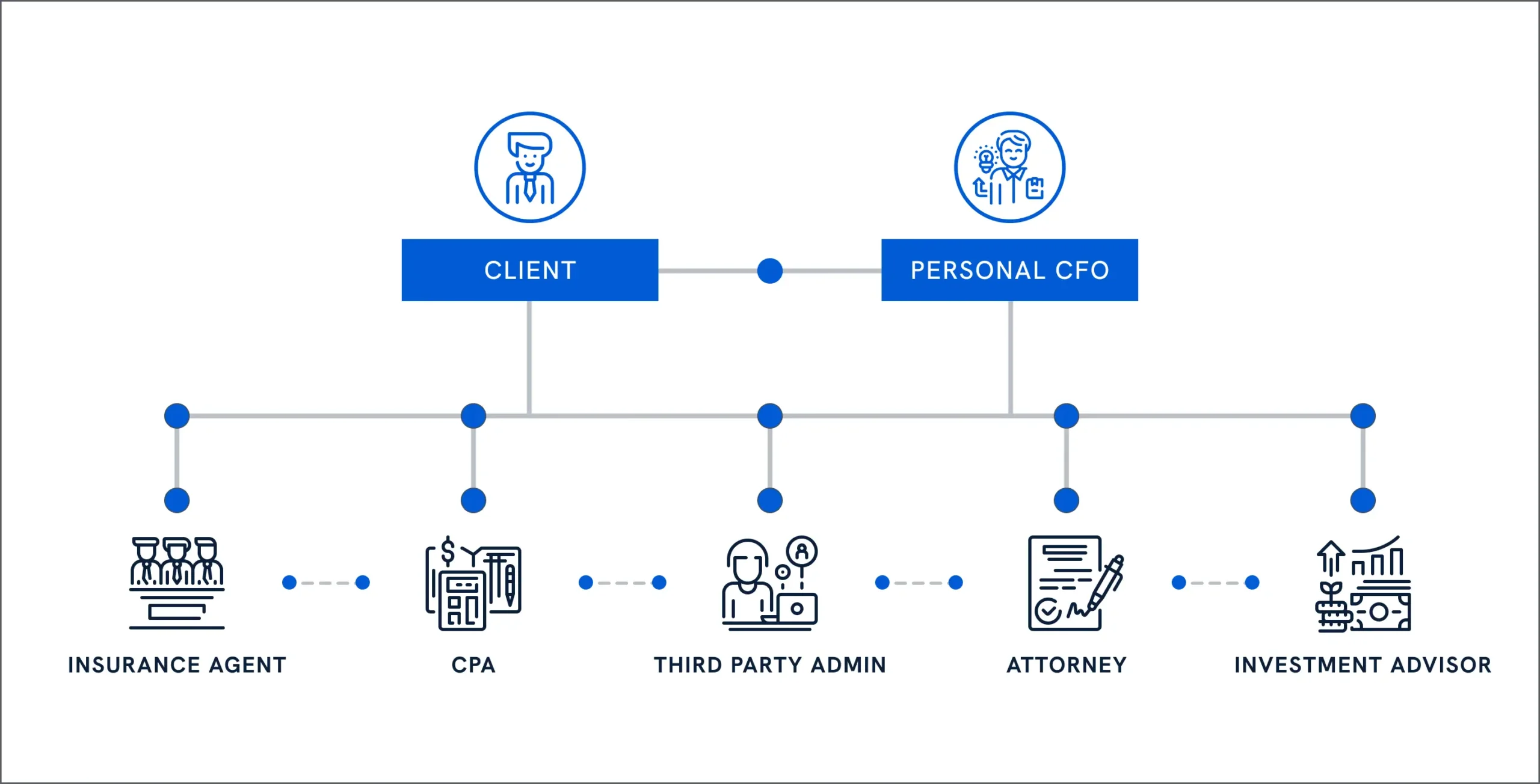

By partnering with a personal CFO, you can stop worrying about your finances and focus on what matters most – your family, patients, and practice.

SERVICES WE OFFER

Benefit from a “financial quarterback” who can oversee your entire financial landscape.

Philosophy that gives investors the best chance of investment success.

We share our knowledge at events and conferences to empower others in achieving financial success.

WHAT MAKES US UNIQUE

STEP 1:

Phone call to learn about you, your goals, and your financial picture to determine how we can help you through creating a wealth plan.

STEP 2:

Virtual meeting to discuss your goals and review your financial picture. Thereafter, we illustrate what we will do for you, how we do it, and why you could benefit from a wealth plan.

STEP 3:

Sign engagement letter, provide payment information, and submit data and documents.

STEP 4:

We will begin to start building a partnership by setting goals, clarifying data and documents, and setting expectations. We foster open communication, transparency, and trust, which are essential for a successful long-term partnership.

STEP 5:

A half day meeting in our Charlotte office where we present the plan, recommended strategies, action items, and results that should be achieved. Thereafter, we send a Wealth Planning implementation checklist of the recommended strategies and action items along with financial information illustrating the projected outcomes.

STEP 6:

We will have a call one month after the Wealth Planning meeting to review the Wealth Planning report and assist with the implementation of the recommendations. Thereafter, we will have two to four calls each year to continue with implementation, monitor the plan, update the plan, provide continuous advice, track the growth of your net worth, and serve as your personal CFO to ensure the desired results are achieved.

FREQUENTLY ASKED QUESTIONS

Explore our frequently asked questions to learn more about our services and how we can help you.

Along with providing financial planning and investment management services, we build customized tax and business plans for dental practice owners. Our background in tax compliance and dental business planning equips us with unique insights, allowing us to cater specifically to the dental industry. This niche focus enables us to deliver tailored solutions for dental practice owners.

Top three reasons: Dental industry knowledge, tax expertise, and over 20 years of experience. I spent over 14 years working exclusively with doctors learning the business side of dentistry, built over 500 tax and business plans for doctors, have big four public accounting tax expertise, and provided investment management services at Vanguard where I managed over $300 million of client assets.

The great Yogi Berra once said “If you don’t know where you are going, you might wind up someplace else.” Trying to achieve your financial goals without a wealth plan is like practicing dentistry without an x-ray – it doesn’t work very well. A wealth plan serves as a comprehensive roadmap to help you make informed decisions to achieve your financial goals and secure your financial future.

Along with providing financial planning and investment management services, we build customized tax and business plans for dental practice owners. Our background in tax compliance and dental business planning equips us with unique insights, allowing us to cater specifically to the dental industry. This niche focus enables us to deliver tailored solutions for dental practice owners.

Top three reasons: Dental industry knowledge, tax expertise, and over 20 years of experience. I spent over 14 years working exclusively with doctors learning the business side of dentistry, built over 500 tax and business plans for doctors, have big four public accounting tax expertise, and provided investment management services at Vanguard where I managed over $300 million of client assets.

No – while investment management is an optional service, doctors may choose to engage our wealth planning service on a stand-alone basis, or they may utilize both the wealth planning and investment management services.

No – our goal is to help doctors achieve financial freedom, including young doctors that have not accumulated a lot of investable assets yet.

We have multiple investment strategy options but our lead strategy is a passive, index-based approach designed to minimize taxes, minimize fees, and provide the philosophy that gives investors the best chance of investment success.

Yes – we do what’s best for the client.

Yes – we work with doctors all over the United States.

Didn’t find the question you’re looking for?

Our comprehensive wealth planning services focus on developing a financial game plan to help you achieve your financial goals.