SERVICES WE OFFER

Personal CFO

Why Doctors Need a Personal CFO?

Do you remember a time when you felt confident managing both your business’s growth and your personal finances? It might seem like a distant memory now. The reality is, as business owners, entrepreneurs, and corporate executives achieve more success, their personal financial matters often get sidelined, despite their growing complexity.

Eventually, there comes a point where managing everything becomes overwhelming. It becomes evident that your time and expertise are better utilized elsewhere, like focusing on running and expanding your business. This is when turning to a “personal CFO” becomes necessary.

While most people understand the role of a CFO in a traditional business setting, managing an individual’s or family’s wealth in conjunction with a business involves a whole new level of complexity. It encompasses various aspects such as tax planning, business planning, investment management, estate planning, and risk management, among others.

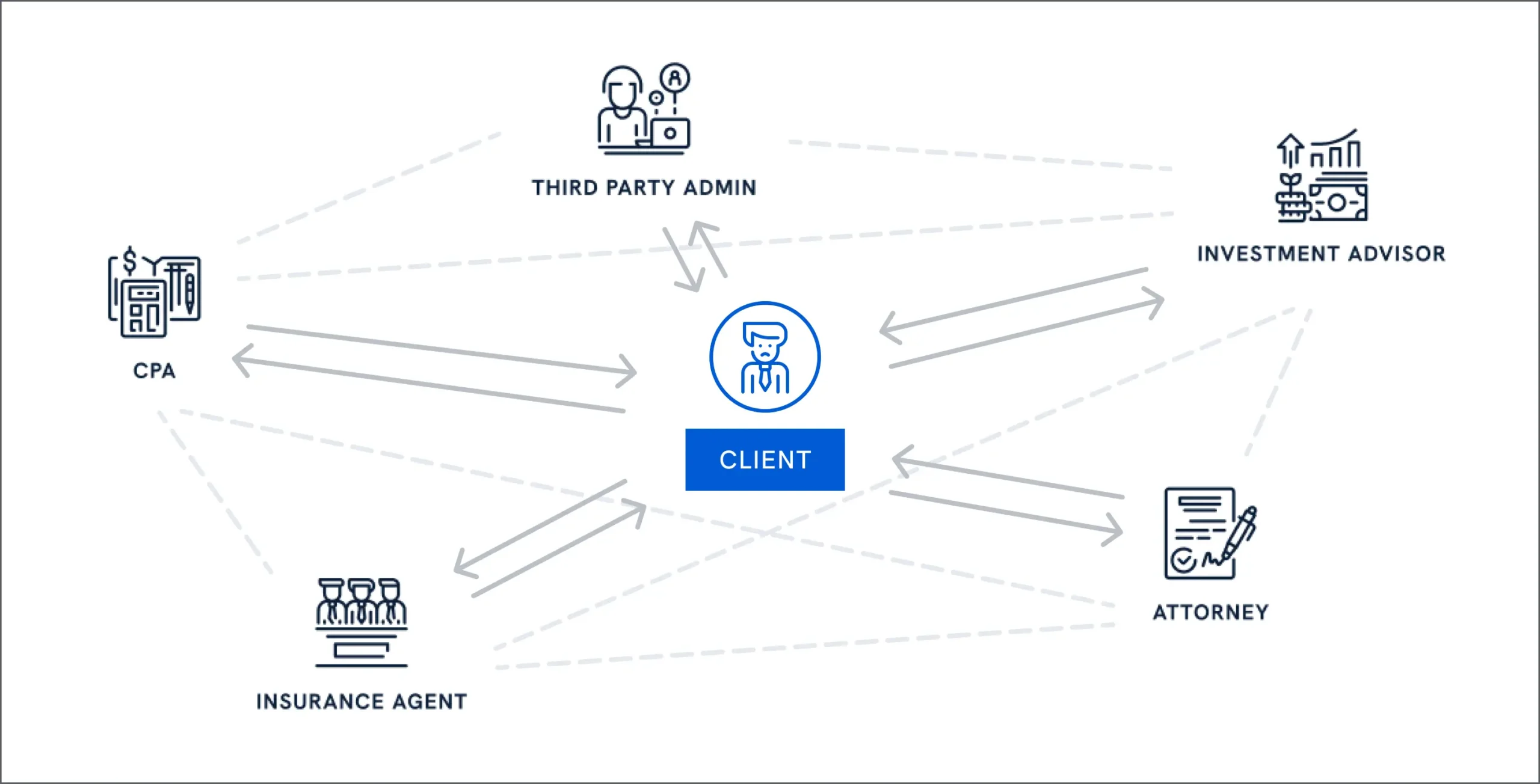

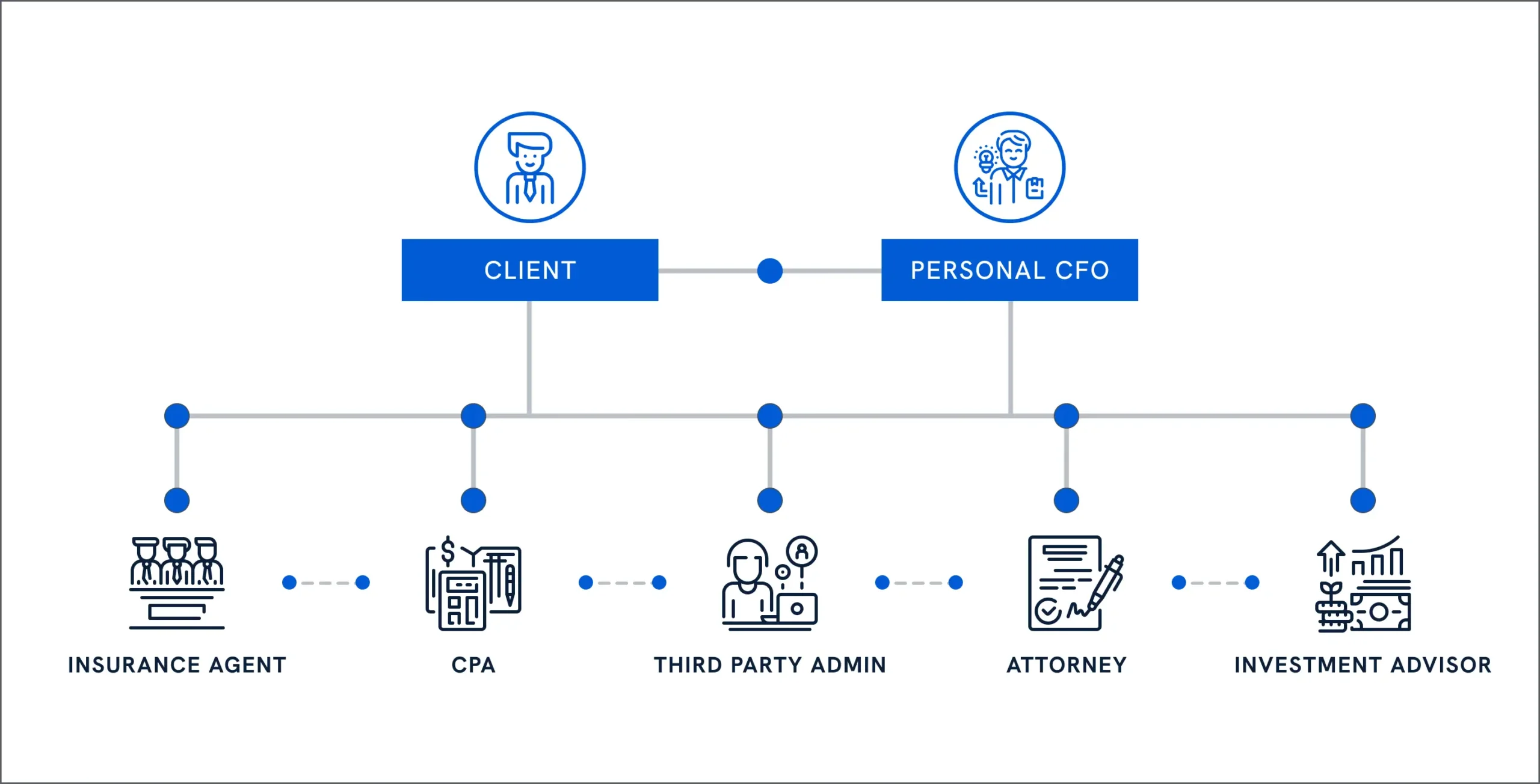

Think of a personal CFO as a “financial quarterback” who can oversee your entire financial landscape, including both your personal and business matters. They help assemble and lead your team of advisors, ensuring seamless coordination to address your comprehensive wealth planning needs.

So, what exactly can a personal CFO do for you and your family?

Here’s a brief overview:

- Develop a financial plan, including tax planning, business planning, and investment strategies.

- Proactively provide advice and recommendations tailored to your financial goals to continue to growth your net worth.

- Assemble and oversee a team of third-party advisors, ensuring they work in harmony to serve your best interests.

- Consolidate and analyze all your financial accounts and documents to provide a clear, accessible overview of your financial situation.

It’s important to distinguish between a business CFO and a personal CFO. While a business CFO may excel in their domain, they may lack the specialized skills needed for personal wealth strategies. Entrusting these responsibilities to a personal CFO allows you to focus on your strengths without losing critical financial support.

FREQUENTLY ASKED QUESTIONS

Have questions? We have answers

Explore our frequently asked questions to learn more about our services and how we can help you.

Along with providing financial planning and investment management services, we build customized tax and business plans for dental practice owners. Our background in tax compliance and dental business planning equips us with specialized insights, allowing us to cater specifically to the dental industry. This niche focus enables us to deliver tailored solutions for dental practice owners.

Top three reasons: Dental industry knowledge, tax knowledge, and over 20 years of experience. I spent over 14 years working exclusively with doctors learning the business side of dentistry while building tax and business plans for them, have big four public accounting tax experience, and provided investment management services at Vanguard where I managed assets for high-net-worth individuals.

The great Yogi Berra once said “If you don’t know where you are going, you might wind up someplace else.” Trying to achieve your financial goals without a wealth plan is like practicing dentistry without an x-ray – it doesn’t work very well. A wealth plan serves as a comprehensive roadmap to help you make informed decisions to achieve your financial goals and secure your financial future.

Along with providing financial planning and investment management services, we build customized tax and business plans for dental practice owners. Our background in tax compliance and dental business planning equips us with unique insights, allowing us to cater specifically to the dental industry. This niche focus enables us to deliver tailored solutions for dental practice owners.

Top three reasons: Dental industry knowledge, tax expertise, and over 20 years of experience. I spent over 14 years working exclusively with doctors learning the business side of dentistry, built over 500 tax and business plans for doctors, have big four public accounting tax expertise, and provided investment management services at Vanguard where I managed over $300 million of client assets.

The great Yogi Berra once said “If you don’t know where you are going, you might wind up someplace else.” Trying to achieve your financial goals without a wealth plan is like practicing dentistry without an x-ray – it doesn’t work very well. A wealth plan serves as a comprehensive roadmap to help you make informed decisions to achieve your financial goals and secure your financial future.

No – while investment management is an optional service, doctors may choose to engage our wealth planning service on a stand-alone basis, or they may utilize both the wealth planning and investment management services.

No – our goal is to help doctors achieve financial freedom, including young doctors that have not accumulated a lot of investable assets yet.

We have multiple investment strategy options but our lead strategy is a passive, index based approach designed to minimize taxes, minimize fees, and provide the philosophy that gives investors the best chance of investment success.

Yes – we do what’s best for the client.

Yes – we work with doctors all over the United States.

Didn’t find the question you’re looking for?

Benefit from a “financial quarterback” who can oversee your entire financial landscape.